New Business Funding Options For Contractors & Construction Companies

If you need funding for your construction business, you've come to the right place!

LendMate specializes in providing the EXACT funding you're looking for.

We'll prove it. Just keep scrolling!

Need funding now? You've come to the right place!

Choose the funding that's right for you!

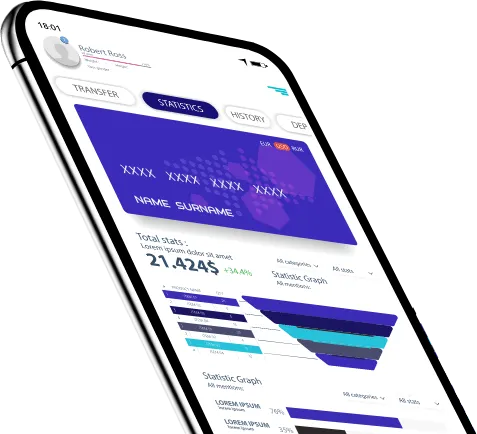

Our safe, secure online application process is perfect for busy business owners like you. Get the ball rolling with our simple 2-minute application!

The money you need is just one click away.

Introducing our loan options designed exclusively for doctors and medical centers, where financial wellness meets digital innovation! Here are the top three reasons why our loan is the perfect prescription for your medical practice:

Lightning-Fast Approvals

Stop waiting! With LendMate, you can relish swift and trouble-free approvals, preserving your valuable time and enabling you to concentrate on what genuinely counts – delivering exceptional service to your clients. No more grappling with paperwork headaches or enduring tedious administrative red tape!

Industrial-Strength Flexibility

We know the financial requirements of contractors. That's why LendMate provides adaptable repayment solutions customized to align with your financial rhythm. Whether it's enhancing your equipment inventory or extending your operations, our loans offer the financial flexibility needed to prescribe the expansion you've earned.

Digital Convenience

Harness the digital advantage! LendMate empowers contractors to apply online right from their project locations. We've streamlined the process, making it as effortless as a perfectly calibrated tool, so you can concentrate on excelling in your field and delivering top-notch results.

Our Business Credit Advisors are here to help you get funded fast!

Comparing different business loan options is crucial because it allows entrepreneurs to make informed decisions and select the most suitable option for their specific needs.

Each loan option comes with unique terms, interest rates, and repayment structures that can impact a business's financial health in the long run. By comparing different options, entrepreneurs can identify the most affordable and flexible loan terms, which can help them better manage cash flow and reduce overall debt.

Moreover, comparing loan options can also help entrepreneurs discover alternative sources of financing that they may have overlooked, such as grants, crowdfunding, or angel investors.

Fill out a simple online application and get connected with your expert Business Credit Advisor!

We're committed to your success!

It's all about relationships! We have relationships with the top lenders in the country to bring you unique options for your business funding.

If you would like to speak with one of our Business Credit Advisors,

click the button and schedule a call!

© 2022 LendMate Brokers - All Rights Reserved,